What are the benefits of solar power for business?

Solar power can contribute to making a business more successful and profitable. There are several reasons why solar power is more ideally suited for a business, as opposed to homes or schools.

Benefits of solar power for businesses

The main reasons why it makes a lot of sense for businesses to consider solar power are the following:

- electricity usage profile matches solar generation profile;

- businesses, in general, have higher electricity tariffs than residential homes;

- businesses have access to finance;

- tax breaks available to business for installing solar;

- contribution of solar to corporate and social responsibility.

1. Electricity usage profile matches solar generation profile

For most businesses, operating hours are between 8am and 5pm and most of the electricity consumption is during operational hours. There is some energy consumption at night, for example from lights, alarms, server, etc, but most of the electricity consumption is during the day. Workers come in each morning and turn on computers, airconditioners, kettles, machines etc, and turn everything off again at night before leaving for home. This means that the time that a business needs energy, is also the time that energy can be generated by a solar power system.

The nature of electricity is that generation must match consumption, If the solar system is able to generate 100 kW of power, but the building only uses 50 kW, then the other 50kW of power generated is wasted. The excess electricity will simply not be able to flow to the building as there is not enough demand for it.

Electricity must be used as it is generated. If it is not used, it goes to waste. The alternatives are to store the excess electricity generated, or to export it to the grid. The disadvantage of storing energy is that energy storage is still relatively expensive. Exporting to the grid is not always permitted, and if it is permitted most network operators do not give fair compensation, paying very little for the energy exported.

In contrast, when generating only for self-consumption, the solar plant is planned and sized to cover most of your own electricity consumption, with minimal surplus entergy generated. Any power that the building needs, that the solar system can not supply, still comes normally from the electricity grid.

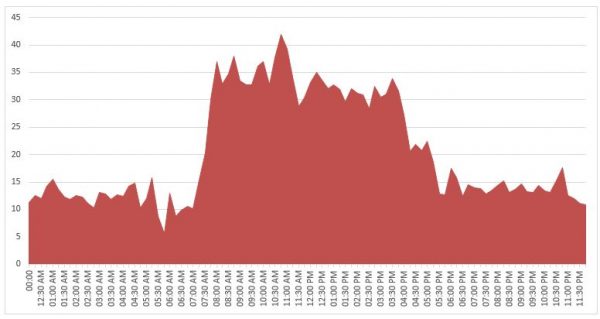

This is a typical load profile of an office-based company.

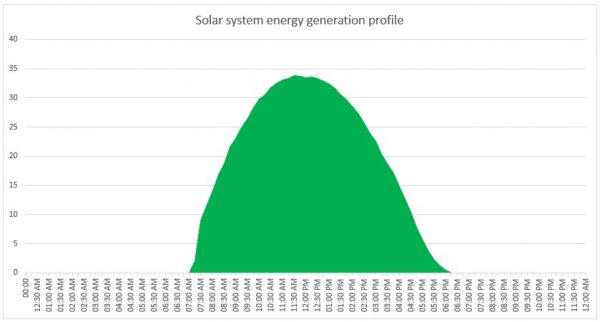

This is a typical energy generation profile of a 40 kW solar system.

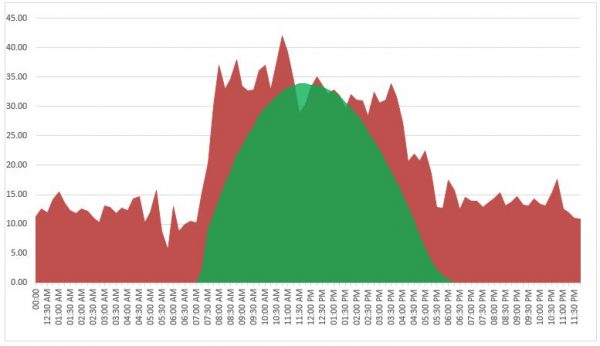

Now, if we impose the typical energy generation profile a solar system, over the load profile of an office building, we get the following result.

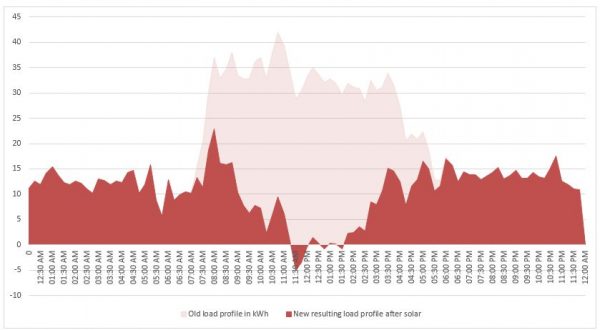

Now, if we subtract the energy supplied by the solar system from the load profile, we get a new resulting load profile like this:

From this graph, one can see that solar power made big difference in the building's load profile and the amount of energy needed from the grid. In this example, solar is able to supply more than 50% of the building´s energy needs. This means a 50% reduction in monthly electricity costs.

2. Businesses, in general, have higher electricity tariffs

Many businesses in South Africa are based in business parks. From experience, we have found that the electricity tariff charged by business parks to tenants is higher than the municipal or Eskom tariff.

Electricity is supplied directly to business parks by the municipality or Eskom. They then distribute the electricity and supply each tenant in the park with electricity. Each tenant is then metered and billed individually. The business park collects the money from each tenant and pays Eskom or municipality.

The tariffs charged to the tenant are higher than the tariffs they paid to the municipality or Eskom to cover the business park´s expenses for distribution, metering and billing.

3. Access to finance

Investing your own capital in a Solar system is a great investment with high rates of returns, but depending on your financial position, financing a solar system could make more sense.

An advantage of financing a solar system is that up to 100% the instalment is recouped by the saving on your electricity bill.

Below is an example of the commutative cashflow of a solar system that was outright purchased and a system that was financed.

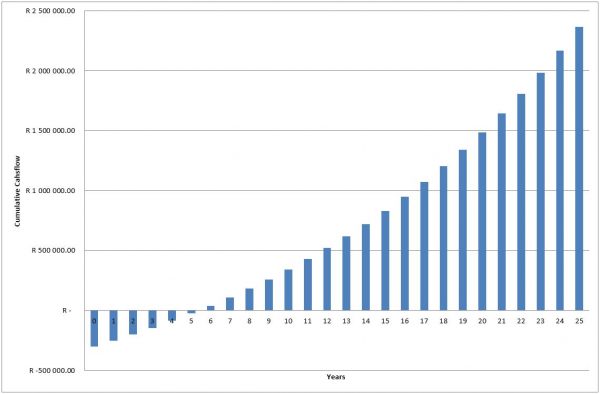

Solar System Cumulative Cash flow - outright purchased

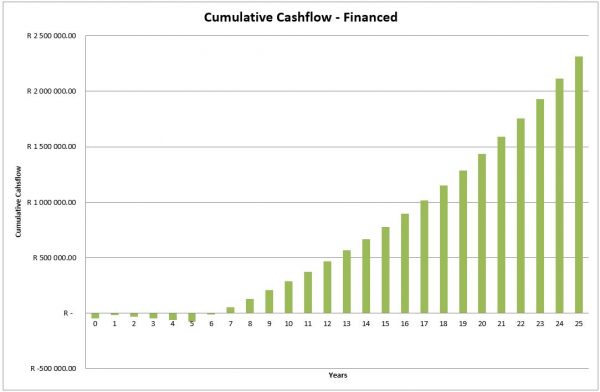

Solar System Cumulative Cash flow - financed

As one can see from the two graphs, financing has very little effect on a business' cash flow, as most of the repayments are covered by the savings on the electricity bill.

The outright purchased system will break even after only 5 years, the financed system after 6 years, due to interest.

Most banks understand solar power systems and are willing to finance solar power systems. There are also various companies that specialise in providing finance for solar systems, for example, Centrafin. Companies with stong financials, have access to affordable finance.

4. Tax benefits

Section 12B of the Income Tax Act makes provision for accelerated wear and tear for assets used in the production of renewable energy provided that:

- The asset is owned by the company, or purchased by it under an instalment credit agreement,

- The asset was brought into use for the first time in the year the deduction is claimed;

- the asset will be used to generate electricity that will be used in the course of the company's trade.

Systems smaller than 1 megawatt, can claim 100% in the first year. Systems greater than 1 megawat can claim the deduction over 3 years (50/30/20)

By claiming the allowance the asset is brought online, the taxable income of the company in that year is greatly reduced, resulting in a reduction of the income tax liability.

Where claiming the section 12B allowance results in an assessed loss for the period, that assessed loss is carried forward to the following tax period. The Income Tax Act does not limit the number of periods that an assessed loss can be carried over, meaning that the company will only be liable to pay income tax when the company´s taxable income exceeds the assessed loss carried forward.

These sort of incentives make investing in renewable energy for your business a worthwhile financial decision.

For more info click here: https://www.saipa.co.za/wp-content/uploads/2019/03/Tax-Chronicle-Issue-8.pdf

5. Corporate and social responsibility.

Business uses electricity as a resource in order to make a profit. This resource usage creates a carbon footprint. As business profits from resource usage, it also has a responsibility to society to reduce it's carbon footprint.

As more and more businesses realise the unsustainability of having profit for their shareholders as the only goal, they see that they also have a responsibility to add value to all stakeholders including employees, society as a whole, and the environment. Within this context, businesses see that they have a duty and the power to reduce their carbon footprint, while at the same time improving profitabilty and long-term sustainability.

Interested what are the benefits of solar power for your business?

Then fill in our form to request a quote/consultation from qualified, pre-approved installers in your area.

23.10.2019 | Schlagwörter: Solar, solar power, solar system, south africa

101 satisfied participants in 8 training courses is a good start

In July and August the maxx-solar academy offered training courses for technicians, consultants and experts in Bloemfontein, Cape Town and Pretoria. The course content met the expectations of all participants. They especially liked the training of the photovoltaic basics, the technical background. All participants appreciated the theoretical and practical knowledge of the lecturers. The participants valued the knowledge of the trainer as very high and enjoyed the variety of practical examples as well as the talk regarding “Lessons learned from Germany”. One participant said: “Well presented and explained by someone with enough knowledge to answer each question and thoroughly”.

19.09.2012 | Schlagwörter: maxx-solar academy, photovoltaic courses, PV training, Solar